SEZs IN LAO PDR

Special Economic Zones (SEZs) development is one of economic improvement approaches which has been prioritized by the government of the Lao People’s Democratic Republic (Lao PDR) since the beginning of economic liberalization. In 2003, the first SEZ namely Savan-Seno SEZ was established, followed by Boten Beautiful Land SEZ and other SEZs.

SEZs are expected to be one of the leading driving forces of economic development and modernization in the country. Not only it provides enabling business environment to host FDI and local private investment but will also spur cross-border cooperation with neighboring countries through offering complementary services and stimulating the creation of regional value chains.

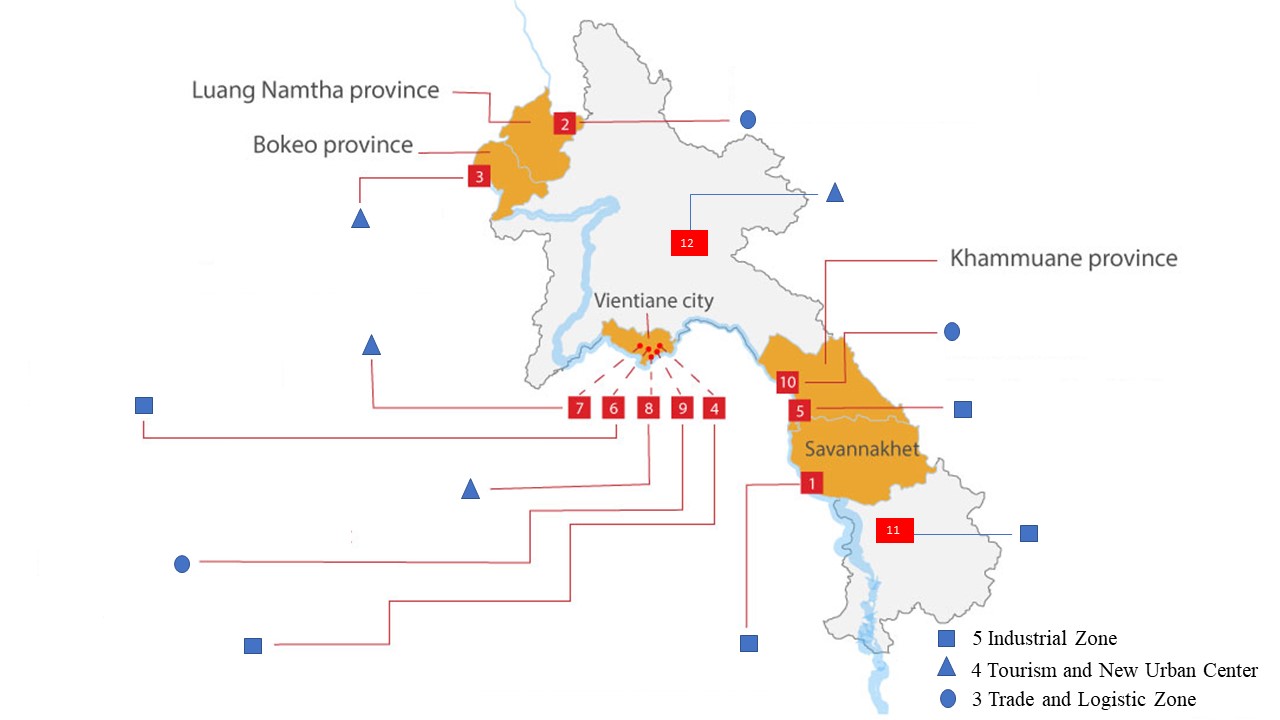

Up to date, 12 SEZs have been developed throughout the country. Special Economic Zone Promotion and Management Office (SEZO) , Ministry of Planning and Investment (www.Laosez.gov.la) is tasked with overall supervision of SEZs, while provincial SEZ management authority (SEZA) in each province, where SEZ is located, is responsible for approving and facilitating business operation in each SEZ.

SEZs in Northern Part of Lao PDR |

SEZs in Vientiane Capital |

SEZs in Central Part of Lao PDR |

SEZ in Southern Part of Lao PDR |

|

|

|

|