Application for establishing Representative Office “RO” (Article 47 of Investment Promotion Law 2009)

- Foreign legal entity with the purpose of establishing the Representative Office (RO) in Lao PDR must submit the proposal to Investment One-Stop Service (OSS), Ministry of Planning and Investment (MPI) for consideration and issuance of the certificate of representative office establishment.

- The certificate acknowledges the legitimate rights of the representative office to enable their movement in accordance with the roles, rights and duties, mainly in investment data collection for the mother company to use as a base in considering the investment in Lao PDR, but it does not allow operating the business.

- Registration certificate of representative office including Tax identity number.

- Age of representative office is 1 year.

A. Conditions of establishing the representative office.

- Must be the legal entity company in foreign country.

- The purpose of establishing is to study and collect data for the investment possibility in Lao PDR.

- Activity of the application for establishing the representative office in Lao PDR is based on the activity of the main company (to study and collect similar data as of the main company).

Remarks: Representative offices have no rights to operate the business in all forms, including investments, trades and services (Article 30 of Law Implementation Decree No. 119/PM, dated 20 April 2011).

B. Complementary documents submitted for the request of establishing the representative office.

- Application for the establishing the representative office.

- Regulations of the representative office proposing the establishment.

- Letter of agent appointment and/or Power of Attorney from the mother company to apply fora representative office establishment in Lao PDR with a copy of passport and brief biography of the appointed person.

- Legalized copy of registration certificate of Mother Company.

- Copy of regulations of main company.

- Office rental contract with rental tax payment receipt*

- Map of office location certified by village authority.*

- Property list of representative office (fixed properties)*.

- Staff name list*.

*Items 6-9 are required for obtaining tax identity number.

– Complementary documents in 5 sets in total.

C. Complementary documents requesting approval of regulations of the representative office

- Proposal to request the certifying of regulations of representative office;

- Draft registration certificate of the representative office;

- The application for establishing the representative office 1 set;

– Documents requesting the certification of regulations are in 5 sets.

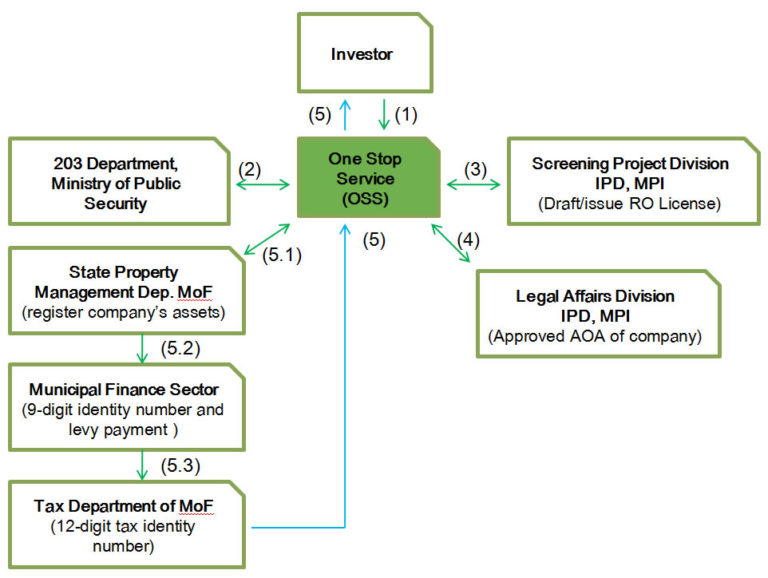

- Investors prepare the complete set of request, then submit to One-Stop Service of Investment Promotion Department (IPD);

- Request comments from 203 Department of Ministry of Public Security;

- Draft registration certificate form of the representative office to use as a complementary document in regulations certification and tax identity number request;

- Investors must prepare the Article of Association (AOA) form of the MPI for company’s AOA approval (5 sets) with comments from Public Security, and attach the draft of the representative office registration certificate;

- Investment One-Stop Service Office prepares a referral letter to apply for the 12-digit tax identity number (Tax Department) and to be handed over to OSS of MPI with the following procedures:

5.1 Investors must have registered the company’s assets with State Property Management Department, Ministry of Finance (with coordination of OSS’s technical officers);

5.2 In case the office is located in the municipal, the investors must submit the forms to the municipal Tax Section and receive 9-digit tax identity number and pay the levies(rate of levies is determined in Annexe I).

5.3 After that, the investors submit all documents to Tax Department,Ministry of Finance to request the 12-digit tax identity number. - IPD (Project Research and Analysis Section) issues the representative office registration (set tax identity number in the same paper) and OSS hands over the representative office certificate to the investor;