PROCEDURES FOR REQUESTING THE REGISTRATION OF CONCESSION REGISTRATION CERTIFICATE AND INVESTMENT LICENSE

The application for registering the concession registration certificate (electricity, mine, agriculture and other activities in relations to concessions, rights concessions and tactical activities) has the following procedures in issuing concession registration certificates:

Complementary documents requesting the certification of company’s regulations.

- Proposal to request the certification of company’s regulations;

- Draft of investment license / draft of concession registration certificate;

- Application for company establishment: 1 set;

Documents requesting the certification of the regulations: 5 sets.

Fee for Application form, Fee for registering the assets and requesting tax identity number:

- Application for tax identity number (Tax Department): 25.000 Kip/set;

- Application for tax identity number(Tax Section of Vientiane Capital): 30.000 Kip/set;

- Fee for registering the company’s assets and regulations: Sole company limited, Representative office: 20.000 Kip and Partnership: 520.000 Kip.

Remarks: The above administration fee may be amended periodically, depending on the official imposition of concerned parties.

Documents required for requesting the enterprise code.

1. Requesting the enterprise code consists of the following complementary documents:

- Proposal for enterprise name reservation of the company;

- Application for enterprise registration declaration of the company;

- Contract of establishing the enterprise of the company;

- Company’s enterprise regulations;

- Copy of the application for investment;

Every concession activity approved by Government will receive concession/investment license from CIP at central or local levels. The License is for the establishment of legal entity in line with Lao laws.

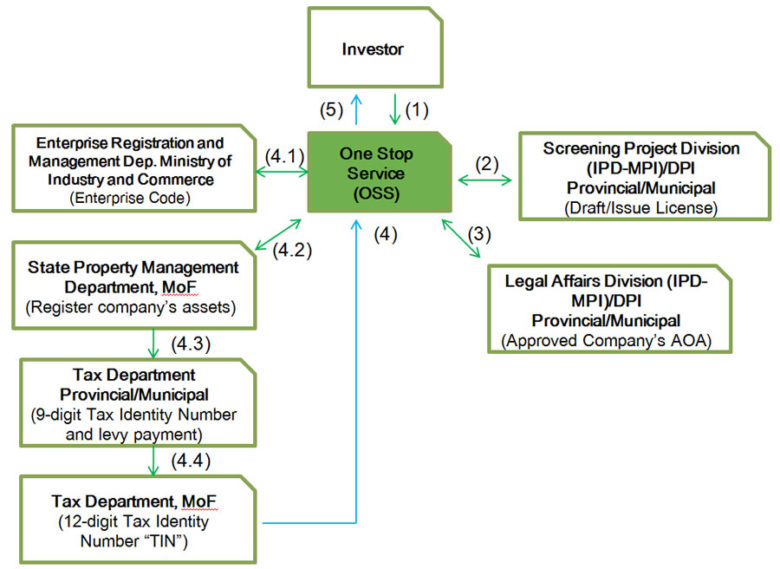

After receiving the approval on principle from the Government, the investors must work jointly with Investment One-Stop Service to prepare documents for requesting concession license as follows:

- Prepare the complete set of form and fill out the form for obtaining the enterprise code and tax identity number, then submit via OSS;

- Draft concession/investment license jointly with investors to verify the correctness;

- Create Article of Association “AOA” (as per the form formulated by Planning and Investment sector) for IPD’s approval (a request letter for approval and 5 sets of AOA);

- One-Stop Service prepare referral letter to request the enterprise code and 12-digit tax identity number (issued by Tax Department) and hand-over to OSS of the MPI Section with the following procedures:

4.1) Investors must submit complete set of application form and referral letter to apply for the enterprise code from the Enterprise Registration and Management Department, MoIC;

4.2) Investors must register the company properties with State Property Management Department, Ministry of Finance “MoF” (in coordination with OSS technical officers). In case the investors have received the license at local levels, i.e.: provinces/municipal, the investors must submit for the company property registration with provincial/municipal State Property Management Section;

4.3) Submit the form to provincial/municipal Finance and receive 9-digit tax identity number (facilitated by local levels) and pay levies (fee rate is determined in next page);

4.4) After that the investors submit all documents to Tax Department of Ministry of Finance to request 12-digit tax identity number. - IPD (project research and analysis section) issue concession/investment license (assign the enterprise code and tax identity number in the same document) and OSS hand over the concession/investment license to the investors;

Remarks: After the investors have received approval from the Government via Committee for Investment Promotion (CIP) at central or local levels,the investors must request the “operating business license” to operate the business activities under the concerned sectors before they can operate the business.

Cost of application form and fees and services (Ministry of Planning and Investment):

| Application form for investment+Article of Association (AOA) form 1set | 50,000 Kip |

| Concession License | 70,000 Kip |

| License to establish a Representative Office (RO) | 70,000 Kip |

| Approve AOA | 30,000 Kip; |

| Amendment of concession license | 30,000 Kip |

| Issuing legislation change certificates, i.e.application for activity expansion, amendment of stockholders and others | 30,000 Kip |

| Issuance of new contract | 500,000 Kip |

Levies of requesting enterprise registration at Industry and Commerce sector.

Fees, Expenses on Approval and Other Registrations (based on the President’s Statute on Levies and Service Fees No. 003/President, dated 26/12/2012)

Issuance of enterprise registration certificate minimum fee 20,000 Kip, maximum 5,000,000 Kip.

| No. | Registered fund of the enterprise | Kip (LAK) |

| 1 2 3 4 5 6 7 8 9 10 |

Minimum 1,000,000 Kip and below From 1,000,001 Kip to 10,000,000 Kip From 10,000,001 Kip to 20,000,000 Kip From 20,000,001 Kip to 50,000,000 Kip From 50,000,001 Kip to 100,000,000 Kip From 100,000,001 Kip to 400,000,000 Kip From 400,000,001 Kip to 1,000,000,000 Kip From 1,000,000,001 Kip to 10,000,000,000 Kip From 10,000,000,001 Kip to 20,000,000,000 Kip More than 20,000,000,001 and above |

None 20,000 50,000 100,000 300,000 500,000 1,000,000 2,000,000 3,000,000 5,000,000 |

- Application form for enterprise registration: 10,000 Kip/set.

- Proposal form for enterprise name reservation: 10,000 Kip/set.

- Contract of establishment: 10,000 Kip/set.

- Application form for registration: 10,000 Kip/set.

- Regulations: 30,000 Kip/set.

- Printing fees for enterprise registration certificate plus application form for enterprise registration declaration: 70,000 Kip/set.

- Fee for photocopying enterprise registration information: 2,000 Kip.

- Fee for filing + fax for name reservation + license + document registry stamp: 45,000 Kip.

Import-Export.

- Form fee 125,000 Kip.

Movement of domestic commodities.

- Form fee 125,000 Kip.